Trusted by over 800 Lending Companies Worldwide

Powering lending operations for teams in 60+ countries.

How Can Loandisk Help You?

Manage all your customer loans and repayments in one place. Engage with customers with automated SMS and Email. Spend less time doing admin work and more time growing your business.

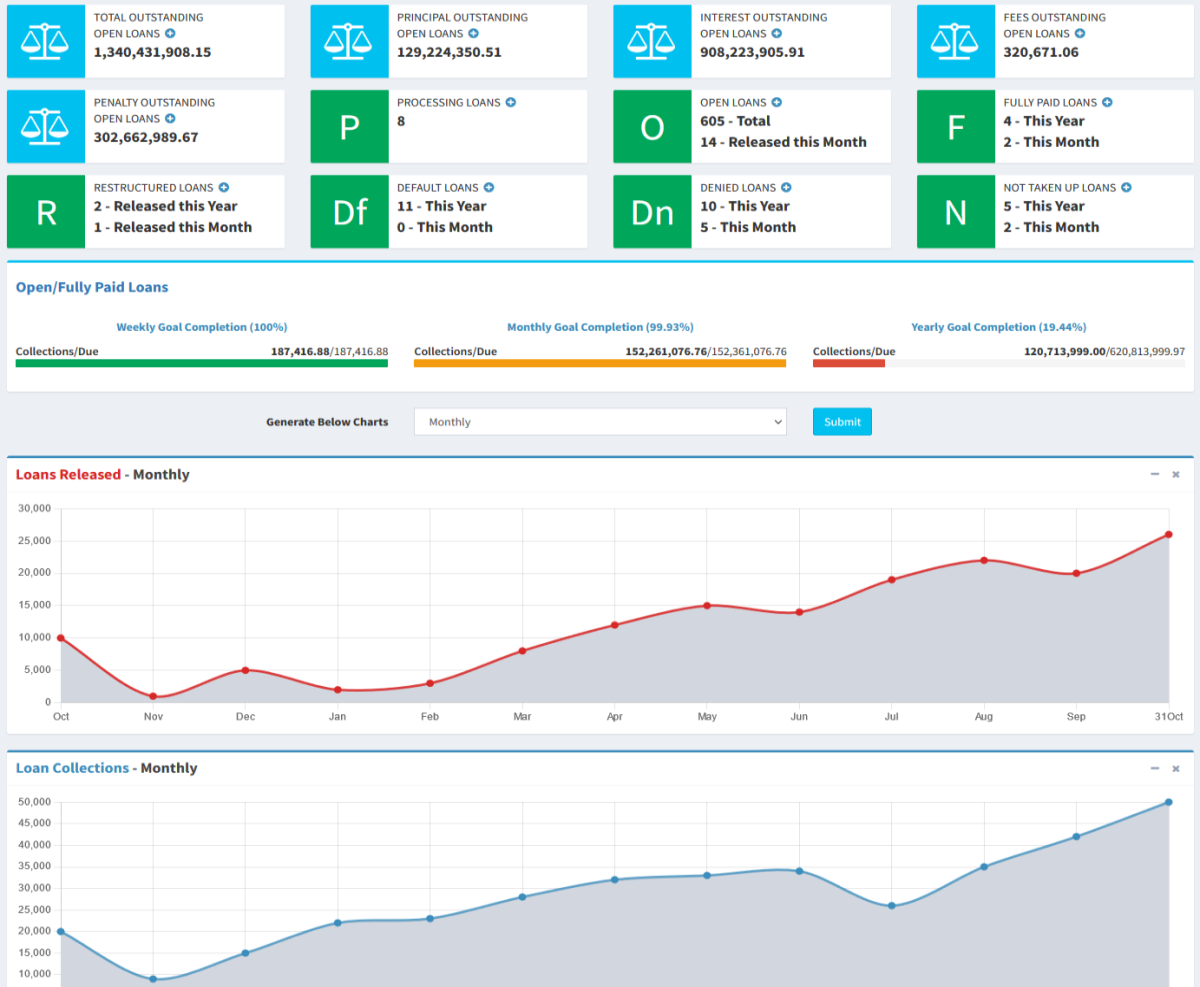

Charts and Reports

View detailed charts and see how your loan released and collections are changing month to month. You can also view cash flow reports and profit/loss statements.

This will allow you to instantly see your business performance through graphic charts and take informed decisions.

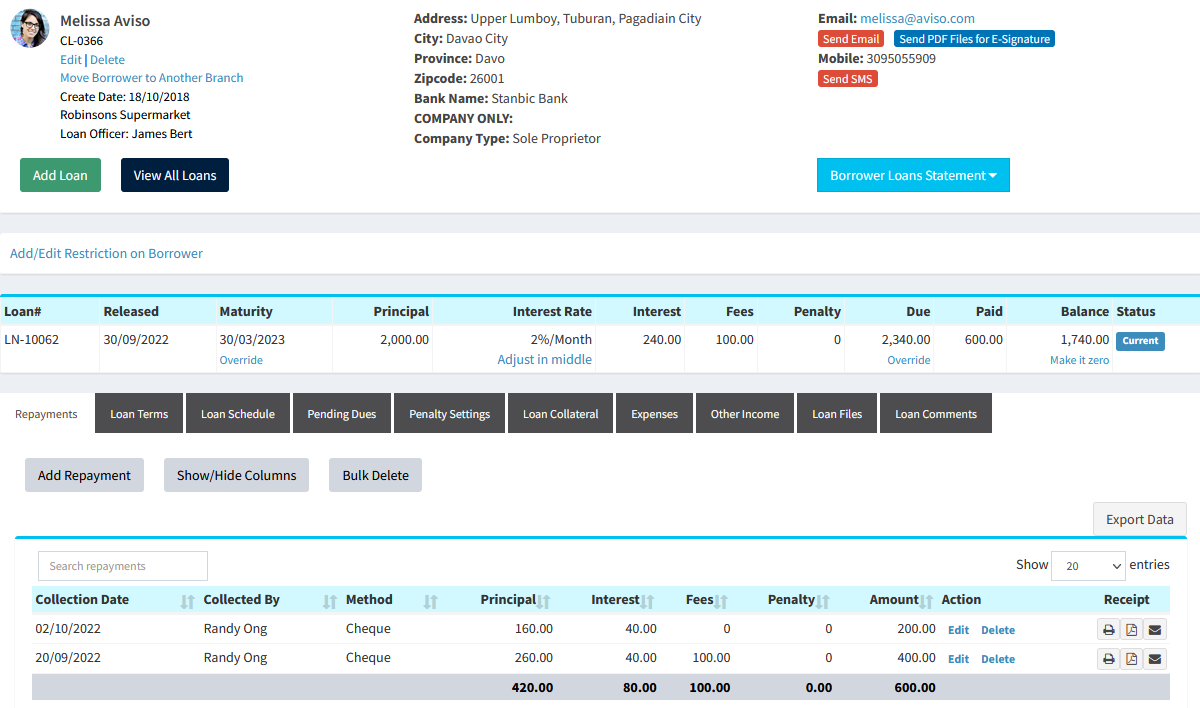

Loan Management

View loan details including repayments, loan terms, loan schedule, collateral, files, and comments. You can also print loan statements and schedule for your borrowers. Set loan fees, and penalties.

See a snapshop of the loan on one page. You can even send SMS and email to the borrower.

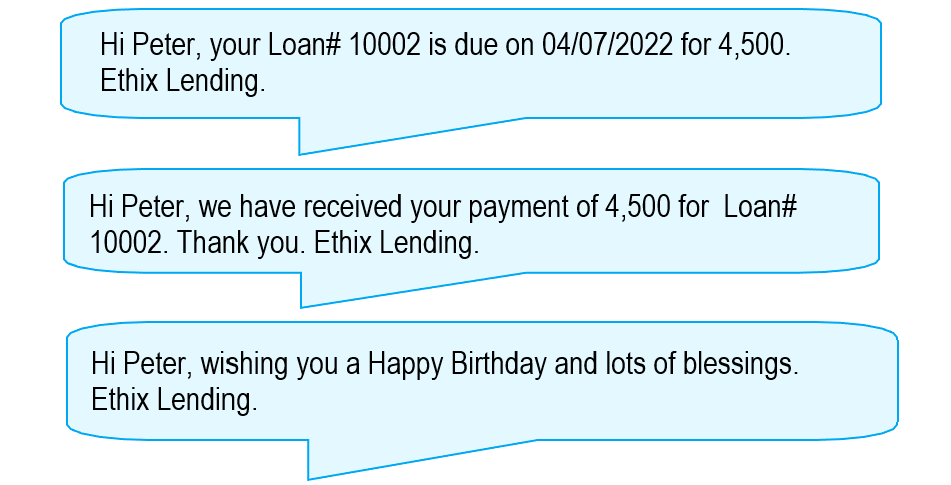

Automated SMS and Email

Send SMS and email to your borrowers for reminders before due dates, arrears, payment confirmation, successful loan application, or even birthdays.

Set your own custom messages with placeholders so each borrower receives a personalized reponse from you.

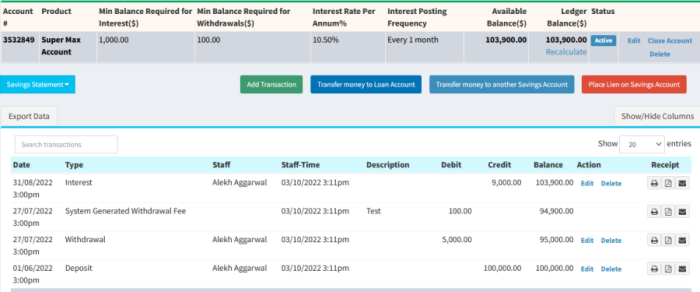

Savings Accounts and Investor Accounts

Create savings account for your borrowers and investor accounts for your investors. Add transactions such as deposits and withdrawals. You can also download and print statements.

The system will automatically add interest to the account depending on your product settings.

Staff Management

Now you can manage your staff like a bank! You can assign branches to your staff and give them roles such as Cashier, Teller, Operations Manager, Collector, and Branch Manager.

You can set permissions for each staff role and control what pages they can see and the branches they can operate in the admin area.

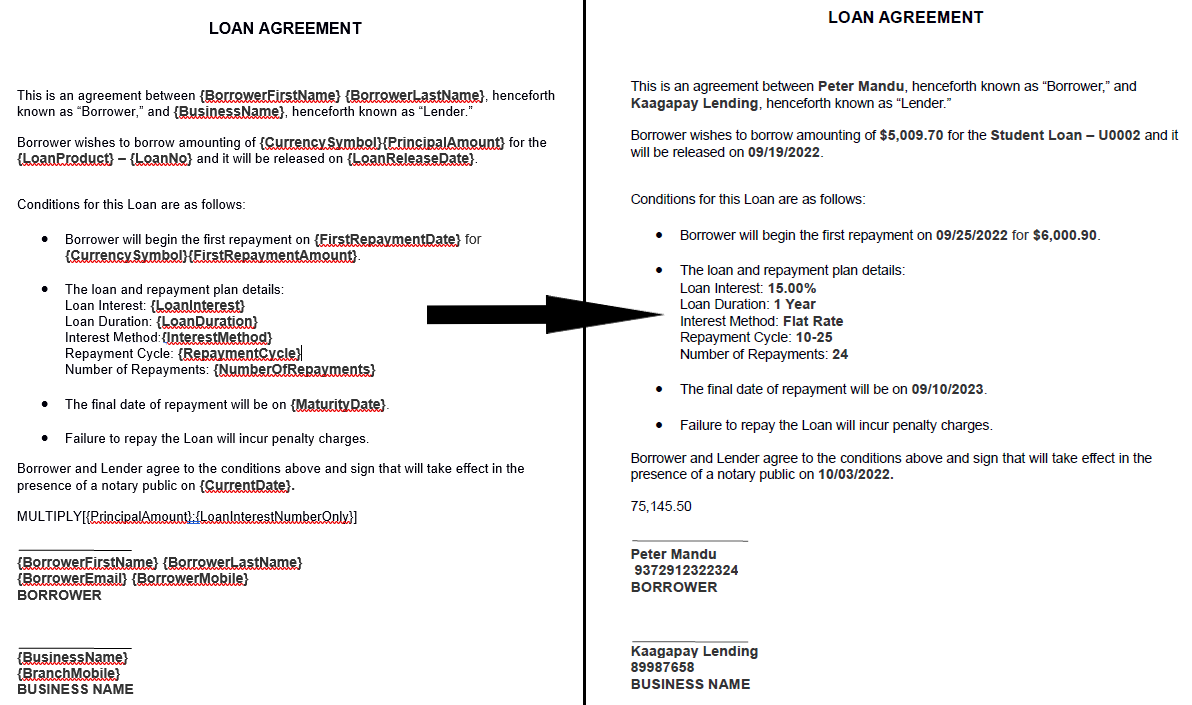

Auto-fill Loan Application and Agreements

Create your own custom application and agreements in DOCX file with placeholders . The system will then replace those placeholders with data from the loan..

You can download the filled agreement in DOCX and PDF or send it via email or for E-Signature to the borrower.

Want to discover all the features?

What are people saying about Loandisk?

We run a microfinance company in the Philippines. We have been using Loandisk for past 2 years and the experience has been great. Now we don't have to deal with endless paperwork. I know exactly what's happening in all my branches. Everything is more organized and secure. We are also able to achieve higher customer satisfaction rates.

Bernadith Ong

Founder, Ethix Microfinance